How to Trade Cryptocurrency in StormGain

So, how many people trade crypto and get piles of money every day?

A few words about crypto

The first digital asset, Bitcoin, was founded in 2009. Different projects then gave the world more and more alternatives, such as Ethereum, Litecoin, Ripple, Bitcoin Cash and others. According to Coinmarketcap, there are more than 2,000 cryptocurrencies. Active traders are spoiled for choice.

However, less active or new altcoins may have limited trading opportunities as they provide fewer buyers when its time to sell. Traders want to be sure of their success, so they only focus on some of the leading cryptocurrencies.

How traders define the value of different projects

Crypto coins are generated by computational alchemy, also known as mining, that requires a lot of processing power to produce new coins. The higher the hashrate is for each chain, the more transactions the chain can process. This gives rise to greater demand and value.

What is cryptocurrency trading?

Trading is an extremely complicated activity. Its not just about money and mathematics but also about stress, information processing, fast decisions and cool, collected actions. Warren Buffet, George Soros and Steven A. Cohen all build capital today because they understand how the market reacts to different facts. Therefore, they understand trading.

Michael Novogratz is one of the most successful cryptocurrency traders. He made his fortune on Bitcoin, Ethereum and different ICOs. How? He understood cryptocurrency trading. In 2013, he remarked that a trader could invest in Bitcoin, come back a few years later, and see their investment greatly increased.

He was right because, at that time, Bitcoin was trading at a price of around $200 per coin. In 2017, it had reached $20,000. Even now, its much higher than $200. The profitability of Novogratzs cryptocurrency investments turned out to be incredibly high.

How does crypto trading work?

If you want to earn as much as possible, you must know this. We can provide the theory and explain someones experience, but youll only see the full picture through practice.

Firstly, learn some main principles:

- Cryptocurrency trading is similar to real market trading, but it isnt a fraction of a regular stock exchange.

- Its a 24-hour market.

- The crypto market is especially volatile.

Secondly, you must understand the standard way of working with crypto exchanges:

- Traders send their existing coins to an account on an exchange or use a platform to buy crypto.

- They observe the prices of other assets available on the exchange.

- They select their desired trade.

- Traders then place buy/sell orders.

- The platform finds a seller/buyer to match orders.

- The exchange completes the transaction.

An exchange platform charges a fee for every trade. Its usually around 0.1%, which is high. Why? Because daily trade volume is over $55 billion. The lucky ones built significant capital doing this.

Theres one last fundamental thing to understand: traders dont just use their maths skills. Experienced traders know that such an enormous market needs more to earn money. Therefore, they use many different programmes to choose the right asset for the right time. This may involve software to help analyse the market.

Financial engineering is the use of innovative technologies to analyse more statistics in a shorter time. It helps invest in the best fields or currencies.

How to begin trading cryptocurrency

You may be an experienced stock market trader or a newbie who doesnt know how to start trading cryptocurrencies. Real stock market traders have only one advantage: they know technical analysis, so they dont need to learn trading fundamentals.

Even though youre full of motivation and want to see the algorithm for using an exchange, you arent ready yet. You first need to learn vocabulary to gain an understanding of how to trade cryptocurrency.

Main terms in cryptocurrency trading

|

Name |

Definition |

|

Spread |

The gap between two indices for buying and selling an asset. |

|

Lot |

A set of coins used to specify the optimal size for trades. The set may consist of small amounts of the cryptocurrency (e.g., 0.01 BTC). The full lot can be tiny (e.g., 1 LTC). However, some altcoins are traded in huge lots (e.g., 10,000 DOGE). |

|

Leverage |

The opportunity to gain a large amount of crypto without paying the full price upfront. Be careful with leverage because it can both enhance your profit or increase losses. |

|

Margin |

The most important fraction of leveraged positions. It describes the initial deposit you set up to place an order. Its expressed as a percentage of the full position. |

|

Pip |

A unit for price movement increments. For instance, a move from $200 to $201 is a pip. Nevertheless, the size of a pip can change in different cryptocurrencies, from a fraction of a cent to $100. |

How to buy and trade cryptocurrency

Youre almost ready to start earning money. But if you want to get something, you have to give something. This rule applies to crypto trading, too. You should send fiat money (or crypto from your wallet) to the exchange.

- Create an account on an exchange.

- Verify it.

- If your budget consists of fiat currency, you need to create a payment channel.

- Verify your identity (if necessary). Usually, exchanges ask for this information because of anti-money-laundering (AML) policies. The other reason is security: they combat trading bots.

- Deposit funds.

So how do you trade cryptocurrency?

Now, try to answer the question: how do you trade cryptocurrency? People will ask it every time the conversation turns to trading. So, short-term or long-term?

Short-term trading is about buying an asset to sell soon after. Usually, beginners think that its after a few minutes or hours. This can be anything from seconds to a few months. You may buy a specific crypto because you think its value will grow shortly.

Pros

- The main benefit is an excellent chance to make a high profit in a very (even extremely) short period of time. Why? Because the cryptocurrency index may triple overnight or within several hours. The fiat currency market cant provide such opportunities because prices usually only change about 1% during a day.

- You can always find a buyer or a seller. People often turn to short-term trading with big projects such as Monero, Ethereum or Dash. These cryptocurrencies have significant demand, so you wont have to wait for each trade.

Cons

- Volatility is the biggest problem in the crypto world. If you perform short-term trades, youll need to spend a lot of time analysing the market before trading. Because of that, you could lose all your money in just one second.

- You must have a good grip on your psychological condition. Short-term trading means that you cant always win.

Long-term trading is about HODLing. You may not know this word if youre new to trading.

HODL means hold on for dear life. Its not in the dictionary but describes the whole long-term trading markets belief that, even if theres enormous volatility, the index will rise over the long term.

Pros

- First, you dont have to make a significant technical analysis with complex trading charts. The recipe is straightforward: you buy and wait. Check the price once a day and sell crypto at the most appropriate time.

- Second, you dont need a big budget. You can buy small amounts and let them grow over a few years. Many people bought Bitcoin for $0.35 and forgot about it. In 5 years, they had a profit of over 60,000x their initial investment.

Cons

- You may lose a good chance for short-term trading. Sometimes, prices rise very quickly, only to fall over a few days. However, if you have enough time and knowledge, you can combine long-term and short-term trading.

- With long-term trading, you dont spend much time on market analysis. Thats why you may miss some news which could influence the price.

Crypto exchanges

There are many platforms, so choose the one that suits you best. They differ, so do some research. Look for:

- Available currencies (be sure that the crypto you want to trade is supported)

- Leverage (high leverage isnt recommended for newbies, but its good for a big profit)

- Hedging (provides insurance and reduces the possibility of loss; good for beginners)

- Minimum investment

- Support (you will have some questions, so choose a platform with good staff).

Also, you have to check an exchanges reviews, security issues and history. Dont work with platforms that raise doubts. There are many good exchanges, such as Poloniex, Kraken or Binance. You can choose any and start trading.

Best crypto wallets for trading

When choosing a digital wallet, you should analyse its history and security issues. It defines the reliability of your investments. We analysed the market and completed a list of the best crypto wallets for trading. The final decision was based on security, the number of cryptocurrencies that could be stored and fees.

- Coinbase

- Exodus

- Copay

- Jaxx

- BRD

- Ledger Nano S, Trezor and Keepkey (for long-term trading).

How to know when to trade cryptocurrency

Crypto trading is very complicated and risky. Theory alone isnt enough to be successful in this market. Trading is based on analysis, of which there are two main types: technical and fundamental. The first one is about graphs. You have to learn trends, price history and just about everything in figures. The second one is about the news — monitor informational websites about cryptocurrency to learn everything as fast as you can.

Crypto trading signals

Its about technical analysis. Signals are trading ideas or suggestions for actions on the exchange that are generated by professional traders or software. You can find these signals on your own. However, if you lack knowledge, its better to buy a subscription. Youll lose less if you have expert suggestions.

Also, you can follow some popular traders on Twitter.

Be careful. People on Twitter can cheat you to get more profit for themselves. Moreover, if they play on their own, they can lie to their own.

Market analysis

The crypto market runs on supply and demand. Because of decentralisation, its free from world politics and economics. While there are still many factors that influence this market, prices can change in just one moment due to the following causes:

- Supply

- Capitalisation (the value of all coins)

- Press releases (the media defines almost everything that happens in the financial world, so follow the news)

- Integration (how different payment systems and exchanges work with each cryptocurrency)

- Key events inside the project (updates, security changes, hacks, etc.).

Market analysis is also known as fundamental analysis. Its essential for trading because it defines your success.

How to get started with StormGain

StormGain is one cryptocurrency exchange that lets you start trading in 4 steps:

- Create an account using your e-mail address and password, and verify it.

- Deposit fiat or cryptocurrency.

- Analyse the market.

- Place a trade.

How do you Open a Trade?

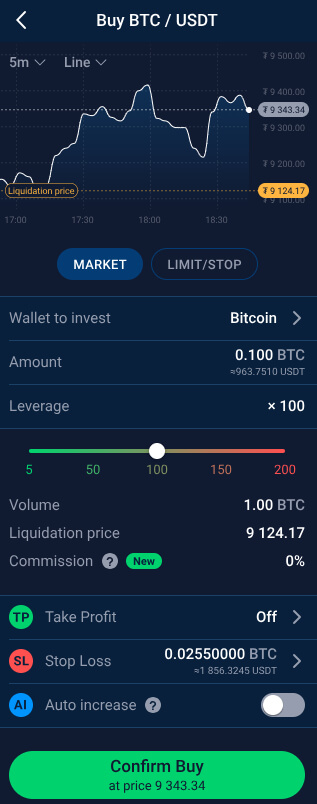

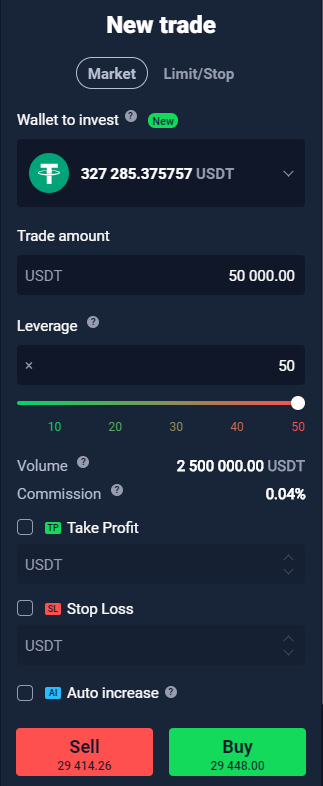

On the trading platform, open the Trading sections list of instruments and select the instrument youd like to trade.

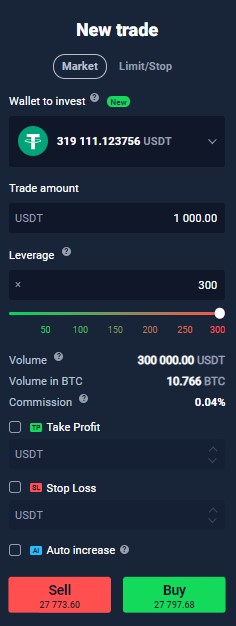

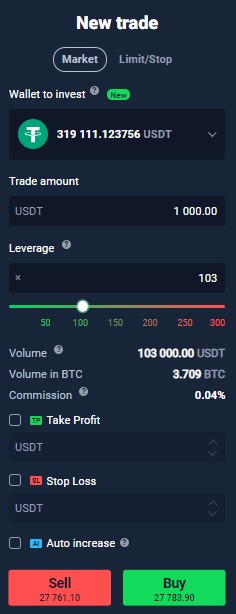

Select a Wallet in the New trade window

Enter the trade amount, set the leverage, Stop Loss and Take Profit levels. If you expect the cryptocurrency to increase in value, select the Buy option, and if you think itll drop against USDT, select the Sell option.

- Stop/Loss can be used by a trader to guard against extra risk. Traders can decide in advance what limits they want to set on their potential risks. You can set the Stop/Loss when reaching a specific price on an open position. Just select the appropriate position from the list of all open positions. You will see a window

- Take Profit can be used by a trader to lock in a certain amount of profit. The cryptocurrency market is extremely volatile, which often leads to situations where the price rises very fast before reversing course just as quickly. Place a Take Profit order to make sure you dont miss your chance to lock in profit. Traders can set a specific price at which the trade will close when reached.

Transaction fees will be applied to every trade. You can see their charge in the Open Position window as well.

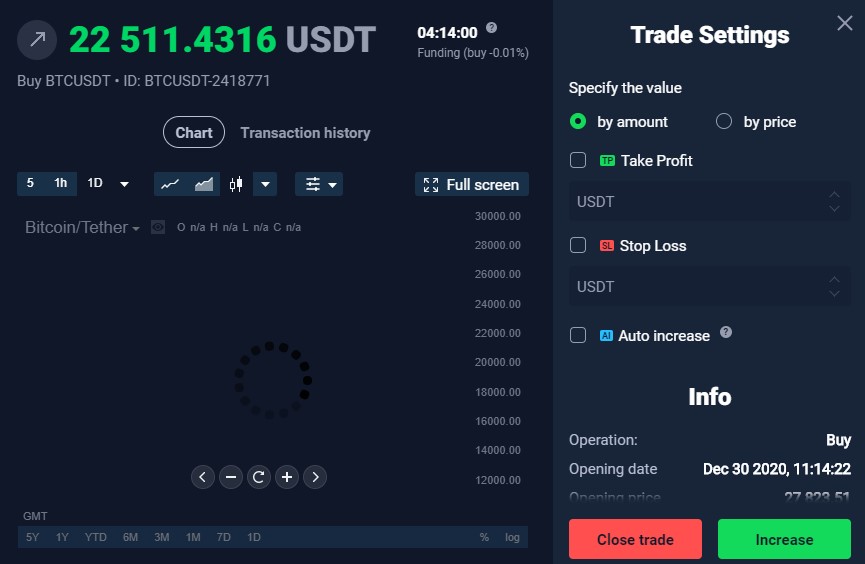

This is what opening a position at a market price looks like.

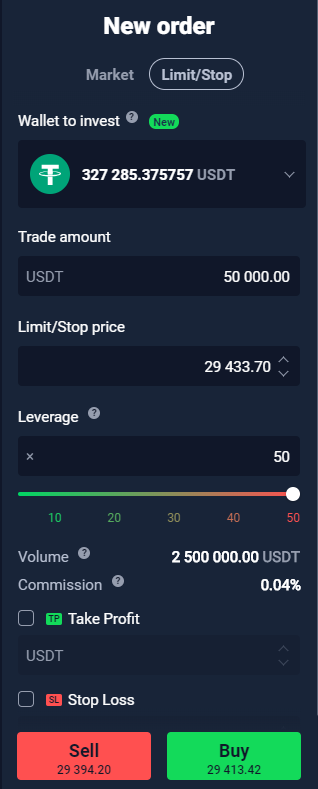

If the current price isnt satisfactory, the trader can open a pending Stop Loss or Take Profit order. The other type, pending orders, are made when they meet certain conditions.

For example, a trader can place an order to open a trade when the price reaches a certain price. Set the trade parameters, the target price for the trade to execute and the trade direction.

To do this, Select "Limit/Stop" tab. After that, set the position parameters, the target price when the deal should open, and the trade direction.

Once this quote price is reached, the position will be opened automatically.

All running trades and pending orders will be displayed in the corresponding section on the platform.

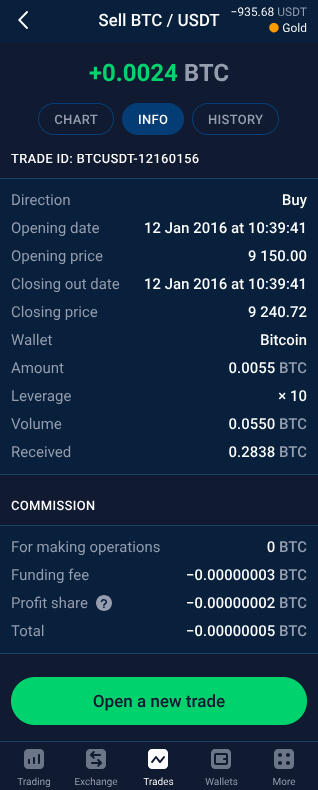

How do you Close your Trade?

Select the trade youd like to close from the trades list. If you hover your mouse over it, you will see a Close button.

When you click it, youll see a window pop up with the trade parameters and confirmation button.

If you click the Yes button, your trade will be closed at the market price.

There is another option. Select a trade from the trades list and click on it. After youve done that, youll see this kind of window:

Here, you can edit your trade parameters or close it by clicking on the corresponding button.

5 golden rules for crypto trading

We cant teach you everything about cryptocurrency trading. Why? Because experience plays a big role. You have to practice to double and triple your capital. Its the first and foremost rule.Fake it til you make it.

Next, analyse as much as possible. He who owns the information owns the world. You cant be a good trader without learning everything about the market.

Dont trade over your capital. Remember about real life. If you dont have enough money for food and taxes, you wont have a clear head to make the right decisions while trading.

Understand the cryptocurrency you are buying. Even if your portfolio consists of 30 different coins, you have to know everything about each of them. Its the only way to invest appropriately.

Lastly, remember that its OK to lose sometimes. You cant always win. If you lose, keep a cool head.

FAQ

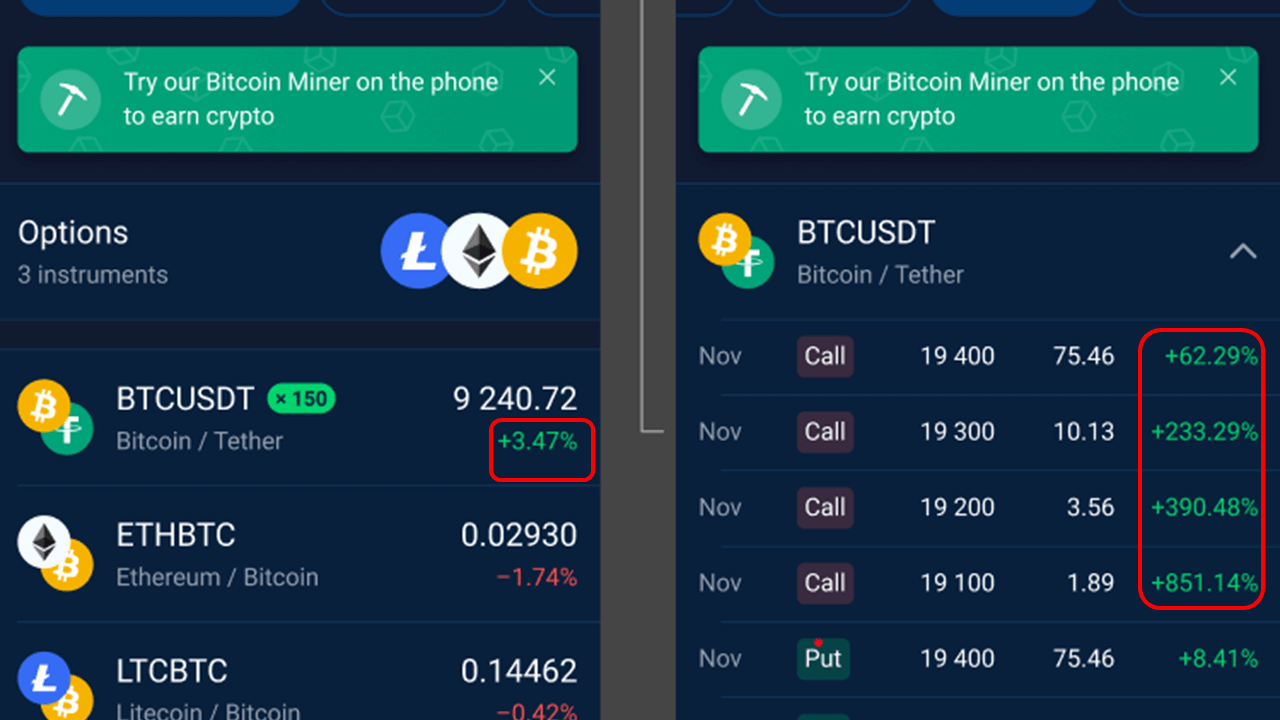

Why should I trade Crypto options?

Perhaps the main appeal when it comes to trading crypto options is that they provide a much higher level of volatility. The higher volatility translates into higher potential profits at a higher risk. The options model price structure makes it so that changes in the price of the underlying asset are multiplied to result in the option’s value. Therefore, crypto options result in much steeper price swings when it comes to the value of the option compared to the underlying asset itself.

Much higher volatility on Crypto options compared with the underlying asset.

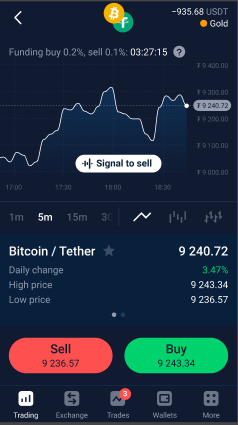

In the example above, you can see that Bitcoin is up 3.47% for the day. Notably, the corresponding price changes for the various Crypto options linked to Bitcoin range from 62.29% to 851.15%. This translates to price changes that are approximately 20 and 280 times greater.

More exposure

Crypto options allow you to take larger positions with the same amount of capital. The reason for this is that the price of options contracts tends to be significantly lower than those of the underlying asset. For example, a call option on Bitcoin may be around $100 dollars depending on your strike price. Let’s say for example that Bitcoin is trading near $10,000. In essence, you can trade the price changes of Bitcoin at a fraction of Bitcoin’s actual cost.

Example

Let’s stick with the Bitcoin example more. Say you think the price of Bitcoin will go up. If you were to buy Bitcoin itself for $10,000, and it jumps to $11,000, you would make $1,000 minus any associated transaction fees to successfully close out your position for a nice 10% return.

Let’s now imagine that you’ve invested the same amount to buy 1,000 call crypto options on Bitcoin, each costing $10, for a total of $10,000. The same $1,000 change in Bitcoin from $10,000 to $11,000 can easily multiply the price of crypto options by 8 to 10 times. While this does occur occasionally, let’s use a more conservative figure and assume that the price of the options increases by 5 times. In this example, if you were to close your position and sell your 1,000 crypto options at the new price of 50 (5 x 10), you would get 50,000 (1,000 x $50) (minus transaction fees). Therefore, you would have realised a 40,000 profit with the same 10,000 investment for a (40,000 / 10,000) * 100 = 400% return.

The above example serves to show the potential returns that crypto options can generate compared to investing directly in the crypto asset itself. While this example could be the case, the reverse is also true to a certain extent. With crypto options, you only stand to lose your initial investment. For example, if the price of Bitcoin falls dramatically after you purchased the $10,000 worth of calls, the most you would lose, no matter how much Bitcoin falls, would be $10,000 - the original price of the investment.

Therefore, it is advisable to invest only an amount that you are willing to lose and manage your risk by using an appropriate Stop Loss level.

Avoid some costs

Another interesting point about trading crypto options is that with them, you are not using overnight swaps. This serves to reduce overall trading costs, and could be particularly important in mid and long-term trading.

Now that you have a better understanding of the advantages and disadvantages for using crypto options, it’s now time to learn about some of the best strategies you can use with them.

What do I need to know about Crypto options?

Crypto options

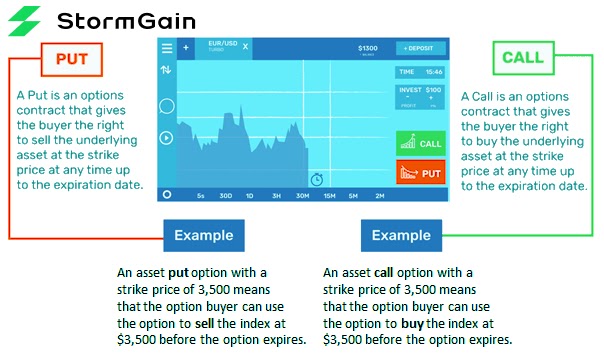

Crypto options differ from traditional options, in that they are derivative instruments that provide the ability to trade on the price fluctuations of the underlying crypto asset without the necessity of actually owning the crypto asset itself. When trading crypto options, you’ll be gaining or losing the difference between the opening and closing price of the position, depending on where it was trading when the crypto option contract was activated.StormGain gives you the power to trade crypto options on a variety of different crypto assets. The crypto assets that can be traded as options can be found in the platform’s Options section, listed as a subsection of the specific crypto asset. Here you will find the different types of options contracts, such as calls and puts, along with expiry dates and strike prices.

Example

For example, below you can see Call and Put options on Bitcoin, expiring in November with strike prices ranging from 19,100 to 19,400.

The key difference between crypto options as derivatives here and traditional, physical options, is that with crypto options, you will not be able to buy the underlying asset at the specified price before expiry. Rather, you’re solely trading the price fluctuations of the underlying asset.

Crypto options vs traditional options

Now that we’ve covered the basics on crypto options, let’s go over some of the basics about traditional options to help you trade even more confidently. Traditional options are derivative financial instruments whose value is determined by the underlying asset, such as a stock, commodity, or equity index. They provide traders the option, but not the requirement, to buy or sell a specified amount of the underlying asset at the price it was trading at when the contract was initiated. Because this is not a requirement, they do not oblige the trader to buy or sell, which allows for greater flexibility.- Call options give the owner the right to buy the underlying asset at a predetermined price within a certain time frame.

- Put options give the owner the right to sell the underlying asset at a predetermined price within a certain time frame.

- The underlying asset is the financial instrument whose price fluctuations determine whether the value of the option goes up or down.

- The strike price is the price at which the underlying asset can be bought, in the case of call options, or sold, with put options, if they are exercised by expiry.

- The expiry, often referred to as the expiration date, is the specified time frame for which the option can be exercised. The period between opening and expiry is known as the “time to maturity.” Please note that the crypto options offered on StormGain expire automatically at their expiration date, meaning that the position will be closed automatically if not sold by then. It’s therefore important to keep a close eye on your crypto options contracts.

What determines the price of Crypto options

Without spending hours going into excessive details and financial formulas, it’s enough to say that the following key points determine the value of crypto options:- The price of the underlying asset is a central determining factor.

- Market volatility is an additional key factor of the price and value of crypto options. Higher volatility typically translates into a higher price for the associated crypto options.

- The date of expiry also influences the price. The greater cushion of time between opening and expiry, the greater the chance is that the option will reach or exceed its strike price. Options with far out expiration dates are known as leaps, and are typically more expensive.

- Lastly, the supply and demand for specific crypto options will influence price.

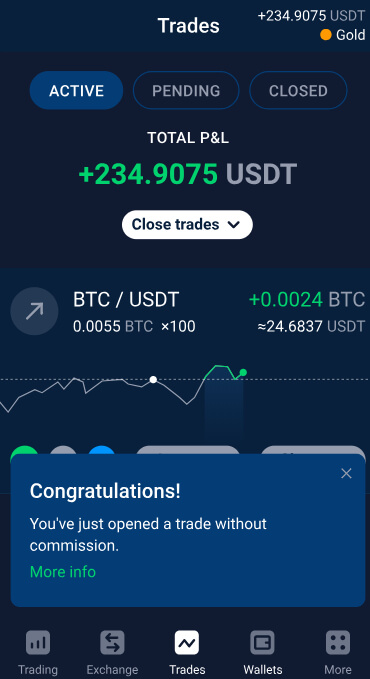

Profit Share

A profit share is an approach that allows users to avoid paying commissions for trades. The only commission, or share, the user pays when the trade is closed with a profit. If the trade losses money, the user doesnt have to pay any fees. But, if the user profits on the trade, he/she just shares 10% of the profit with the exchange platform. Its a classic win-win scenario.

How does it work?

When a user opens a new trade, he/she will see a notification saying that this trade has been opened with a 0% fee.

When closing the position, the trade report will show the user a breakdown of all commissions taken, including the Profit Share, if applicable.

You can find all information regarding 0% commission and profit sharing on the Fees and Commissions - Trading page.

Futures

Futures are the type of derivative contracts. A derivative contract allows traders to speculate on the price movements of assets without ever physically trading the asset. A derivative contract is a tradable contract that is based on the price of an underlying asset. The contract is an agreement a trader makes to enter a trade based on the price of the underlying asset. For example, a Bitcoin future contract is based on the underlying asset, Bitcoin. Therefore, the contract price is very close or identical to the market price for Bitcoin. If Bitcoin goes up, the price of the Bitcoin contract goes up and vice-versa. The difference is that the trader is trading a contract and not Bitcoin. There are a number of different types of derivative contracts that all have different benefits for traders. Futures, perpetual swaps, contracts for difference and options are all examples of different derivatives. They are called derivatives because the price of the contract is derived from the underlying asset.The advantages of derivatives contracts

Different trade directions: traders can profit from both price increases and price decreases, something that is impossible when you are simply buying and selling an asset.High Leverage: traders can open trades that are worth more than their account balance using leverage.

Control exposure: traders can speculate on the price of an asset without ever owning it.

Low barrier to entry: traders are able to trade on an asset’s performance, without investing the equivalent amount upfront.

Risk management: for many traders, derivatives can provide a new means to manage trading risk.

The underlying asset for Stormgain Futures is Index price. The Index Price is derived from spot quotes from major cryptocurrency exchanges such as Kraken, Coinbase, Binance, etc.

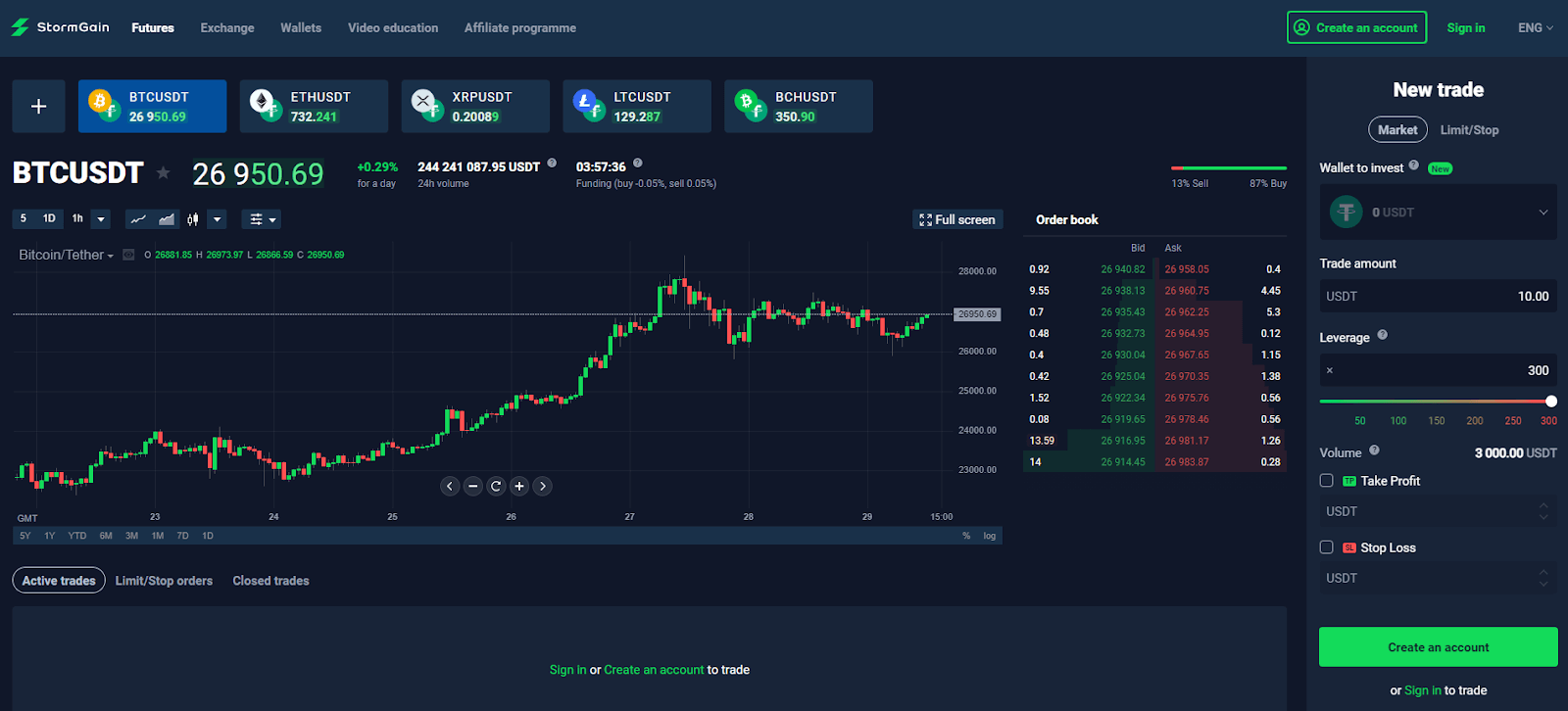

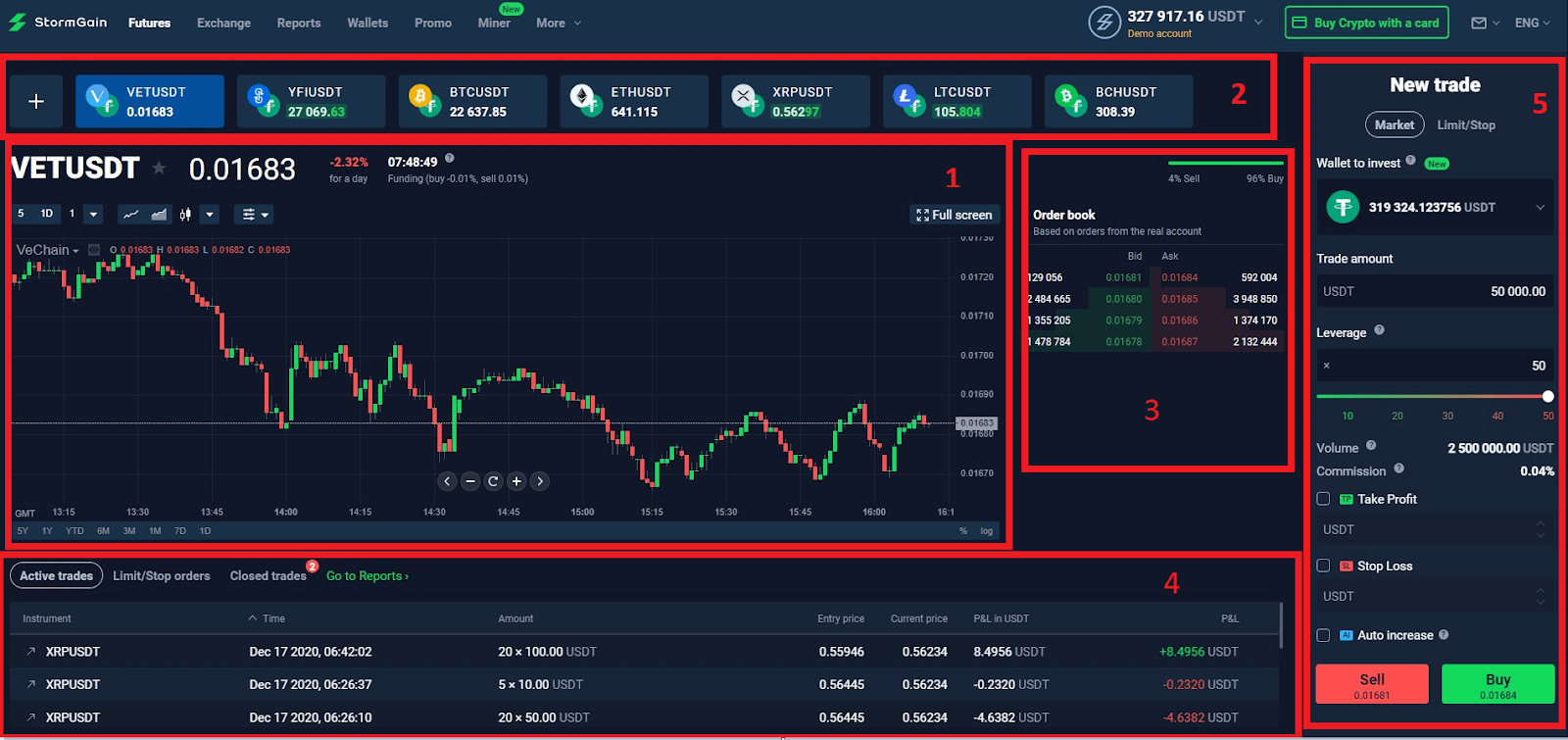

A list of available futures on Stormgain platform can be found in the Futures’ tab:

1. Trading chart

The chart shows the price movement of the chosen asset. Trading chart allows traders to use indicators to spot trends and assess when to enter and exit the market.

2. Instruments panel

This is the list of available instruments. The trader can also add new instruments by clicking on “plus” icon and choosing the necessary instrument from the list.

3. Order book

The order book displays buy and sell orders of a particular financial instrument. More information about Order book can be found by the link https://support.stormgain.com/articles/what-does-order-book-mean

4. Positions Orders panel

This panel contains all the information about trader’s open or closed positions and orders.

5. Order creation panel

This panel is used to create an order and open a trade. There are a number of options when opening a position: trade direction (sell or buy), leverage, risk management (Stop Loss and Take Profit).

What is Bid price and Ask price?

When trading on financial markets, its important to bear in mind that there are always 2 prices at any given moment: the price at which you can buy an asset (the Ask price) and the price at which you can sell an asset (the Bid price).Just think about what its like when you go to the bank to exchange a foreign currency. Youll see two prices on offer there, too: one for buying and one for selling. The Buy price is always higher than the Sell price. Its exactly the same on the cryptocurrency market. The Ask price is what you pay when buying your crypto, and the Bid price is what you get when selling it.

Lets say you want to open a trade. You need to do a bit of chart analysis first if youre going to make the right decision. On the chart, youll see the mid-price. This is the average price of the Bid and Ask prices.

Now imagine you decide to buy. In the open trade window, the price youll see is the Ask. Thats the price youll pay when you buy your chosen coin.

Now that youve bought your desired cryptocurrency, youll eventually have to close it. When you close your position, youll do it at the Bid price. It makes sense: if you bought an asset, now you need to sell it. If you previously sold the asset, now you need to buy it back. So you open a position at the Bid price and close it at the Ask price.

Limit orders are also executed at the Bid price if theyre being sold and the Ask price if theyre being bought. Take Profit and Stop Loss limit orders are similarly executed at either the Ask or Bid price depending on the type of transaction.

Heres the key take-away. If youre selling something, itll be at the lower price (the Bid). If youre buying it, itll be at the higher price (the Ask).

Funding Fee

When trading on the StormGain platform, you will be charged our funding fee several times a day. These fees are applied at regular and equal intervals.The funding fee may be positive or negative depending on your position type (buy/sell) for any given cryptocurrency pair. This is because the fee amount is calculated based on the difference between perpetual market contracts and spot prices. As such, the funding fee is subject to change depending on the market situation.

You can see the funding fee amount and how long until its next debited from your account each time you open a new position.

Figure: Web platform

Figure: Mobile app

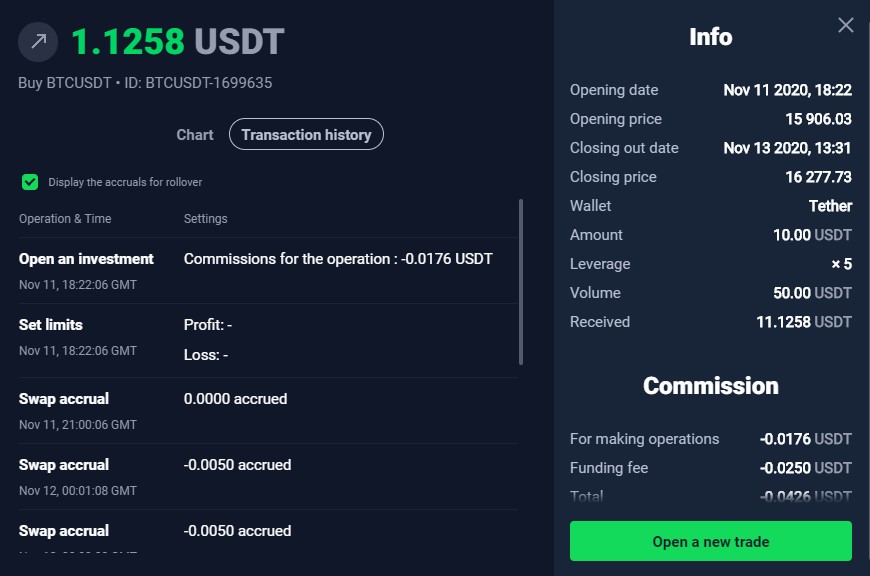

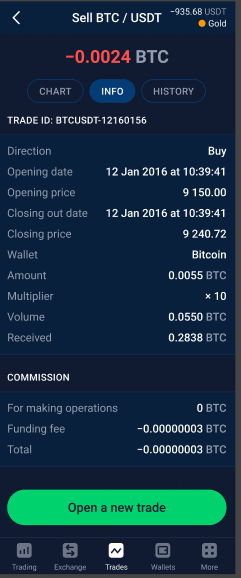

Alternatively, you can find details of the funding fee amount and when it will be debited from your account in your trade reports.

Web platform

Mobile app

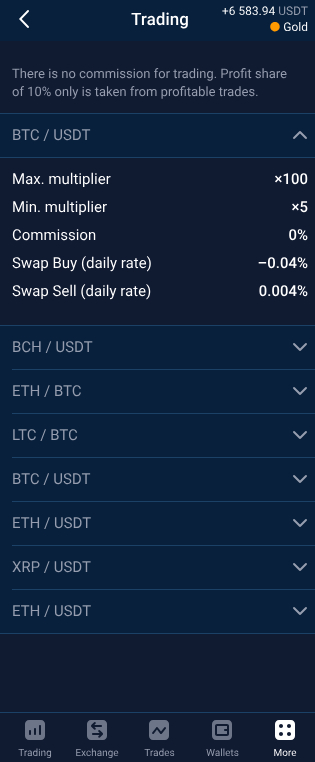

What is a leverage and how can it be changed?

A leverage is used to manage risks when performing a cryptocurrency trade. A leverage also proportionally affects the amount of commission charged when opening trades and moving them to another trading day.The leverage makes it possible to increase profitability on trades. It also allows the funds available on your StormGain account to be used more effectively. Using it is the same as working with funds that are up to 300 times the amount thats available on your account when completing cryptocurrency trades.

The maximum leverage amount to complete trades depends on the trading instrument and can vary from 5 to 300 (with step 1). You can view detailed trading conditions for each instrument, including its maximum leverage, on the Fees and Limits page.

The leverage is set when a position is opened.

The leverage amount can be set manually in the appropriate field or by selecting the desired level on the sliding scale.

The leverage cannot be changed for a position that has already been opened.

Minimum and maximum leverage

Cryptocurrencies can be traded on StormGain with a leverage.A leverage is used to manage risks when performing a cryptocurrency trade. A leverage also proportionally affects the amount of commission charged when opening trades and moving them to another trading day.

The minimum leverage for all available cryptocurrencies is 5. The maximum depends on the trading instrument, ranging between 50 and 200. The leverage can be changed in increments of 1.

Any changes to trading conditions can be found on the Fees and Limits page (https://stormgain.com/fees-and-limits).

Liquidation level

StormGain has a liquidation level. Liquidation level for a specific trade comes into play when the level of loss on a position reaches the amount invested in the position. In other words, when losses reach 100% of the amount the client invested in the position with his own money. At this point, the position will be automatically closed.

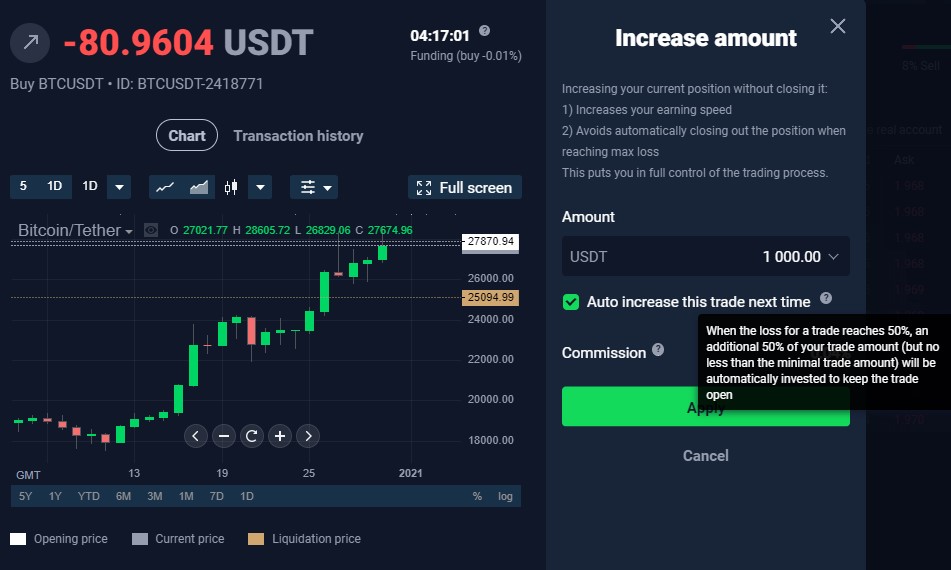

A Margin Call is a warning that the closing threshold is at risk of being crossed. Youll receive a notification when the loss on your position reaches 50% of its total amount. This allows you to decide whether to increase the position amount, update the Stop Loss and Take Profit parameters or close the position.

How to grow your position

You can increase the volume of your trade on the StormGain platform.To build-up an already-existing trade, select the one youd like to build-up from the Open Trades list and click on it once with the left mouse button. You will see a window:

Hit the Increase Amount button.

Enter the amount with which youd like to build up your trade to the Add field. Confirm by clicking on Apply.

You can also set it so that the trade builds up automatically. This can be done with an already-opened trade. Just tick the Build-up this trade automatically for the next time box. Building-up a new trade is also possible.

When opening a new trade, tick on the Autoincrease field.

For this case, every time your losses on this trade reach 50%, an additional 50% of your trade value will be automatically invested to keep the trade open.

How much trading commission do we charge?

There are several types of commission/interest on StormGain:

- Exchange commission for converting one cryptocurrency for another. This is charged at the moment of conversion.

- Transaction commission on trades made with leverage. This is charged at the moment a trade is opened/closed.

- Financing rate. The interest associated with the financing rate may be positive or negative. It is charged or paid out several times a day. This takes place at specific equal intervals of time. For full details, please click here.

An exhaustive list of instruments and their associated commission/interest fees can be found on the website.